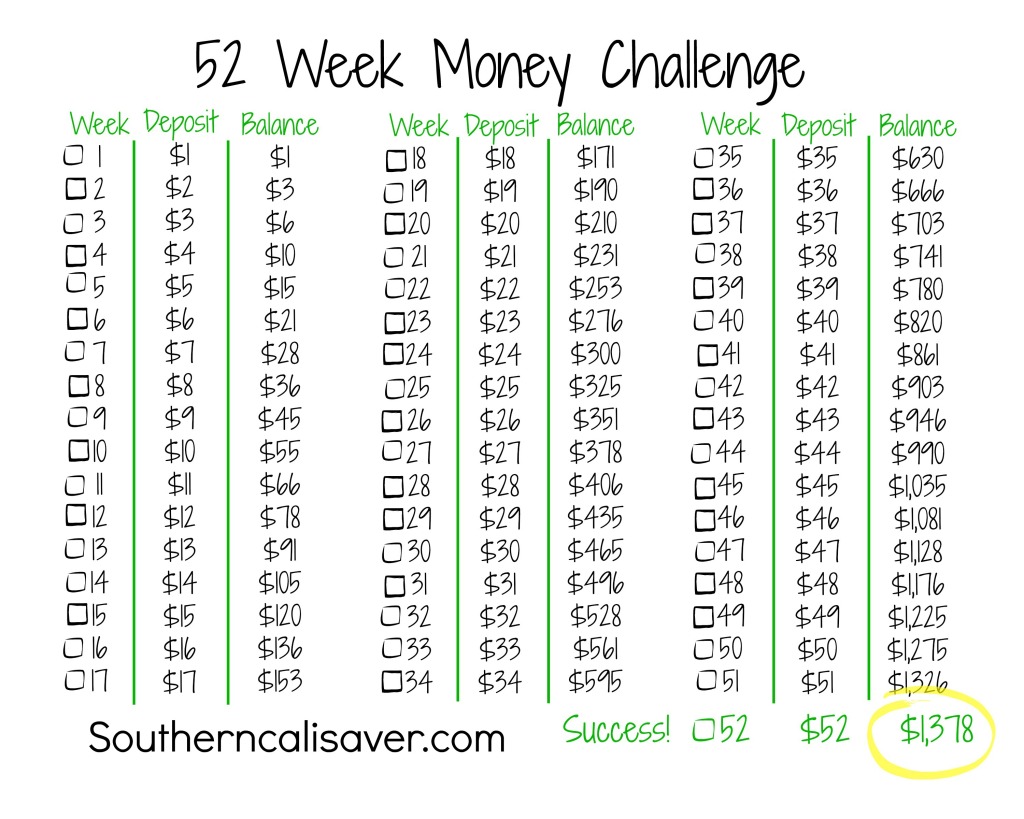

If you are active on social media, then you should be very familiar with the 52-Week Savings Challenge. Essentially, you save $1,378 by the end of 52 weeks by saving in increasing amounts each week. You start with $1 during week one. Then, increase your savings by $1 each subsequent week. That means in week 38 you save $38 and on week 52 you sock away $52.

If saving money is extremely difficult, this is a systematic and simple way to stack your coins without feeling the pinch.

The structure described here is the traditional approach, but there are other ways to go about reaching this $1,378 goal.

Here are four other ways to make your savings grow.

Reverse: If you want to see quicker progress, then consider savings in reverse. Instead of saving $1 the first week, you start Week 1 by saving $52. Week 2, you will save $51, and by Week 52, you only have to save $1.

Traditional Bi-weekly: If you don’t want the hassle of scheduling weekly withdrawals, you would need to calculate how much you would save every two weeks doing this challenge. For example in January, you would need to save: $3 and then $7. In February, you would have to put away $11 and then $15.

Bi-weekly in Reverse: If you want to double up on savings but in reverse, this means that your bi-weekly saving goal in January would be $103 and $99. In February, you will need to set aside two sets of savings: $95 and $91.

Jump Around Method: If you don’t care for the structure of the 52-Week Savings Challenge, but want the outcome, then you can jump around until you have reached the $1,378 finish line. Even though tracking your savings is important for reaching this goal using the aforementioned approaches, you will have to be extra meticulous and organized when using this method. I highly recommend printing out a 52-Week Savings Challenge worksheet like this one and crossing out the amount that you have put away as you go.

Don’t forget to automate your savings with an online account like Capital One 360 or Ally Bank. On the other hand, if you have the discipline and won’t dip into the savings unnecessarily, you can keep this money in a cookie jar, coffee can, or in an envelope.

Frugal Feministas: What say you? Are you game for this?

Saving your money and budgeting correctly are two of the foundational tasks needed to take control of your finances. If you need additional support, I invite you to check out my budgeting course and my savings course.